Married couple, Fred & Ruby A. became timeshare owners as the result of unknowingly being on the other end of an extremely high-pressure sales pitch. Since then, the couple experienced an inability to make use of their timeshare, all while it was becoming too much of a financial hardship for them.

Fred and Ruby had never planned on purchasing a timeshare, and the only reason they were at a sales presentation was that they were deceived into attending. Find out exactly what went wrong with the couple’s timeshare experience below. We hope by sharing their story that more people will come to realize how damaging these timeshares can be. Names have been changed or omitted due to potential privacy concerns.

“In retrospect, I felt like we were profiled and seen as easy targets for their scam. They offered us a $200 gift card just to listen to their one-hour presentation so of course we went. Had we known it would last closer to 5 hours then we obviously would not have gone. But we went and sat through an extremely high-pressure sales pitch that left me shaken. We ended up buying a timeshare but felt like we had to and weren’t given any time to look over the paperwork.”

Not being able to review the paperwork proved to be detrimental for Fred and Ruby. As later reviews showed the documents that they signed were not the same as what was shown during the sales pitch. The couple was paying a higher amount for the mortgage and maintenance fees than expected, but that’s not all that was different.

“The timeshare did not deliver on any of the promises that were made to us before buying. They said exchanging or renting our timeshare would be easy. We were also told our maintenance fees would never increase. Both lies! And that’s not even mentioning how difficult it was to even use the timeshare.”

Like many other timeshare owners, Fred and Ruby were experiencing many issues with using their timeshare. After investing so much money into these properties, you would think it would be quite easy to use but that’s not usually the case.

“I don’t even know why we couldn’t use our timeshare. Everything was just always blacked out on the schedule. I think in our 15 years as timeshare owners, we were only ever able to book two trips. That’s it! And they would take away the points we built up every year if we didn’t use them, but we just could never use them! The salespeople told us that would not happen but we found out most of their promises did not match reality.”

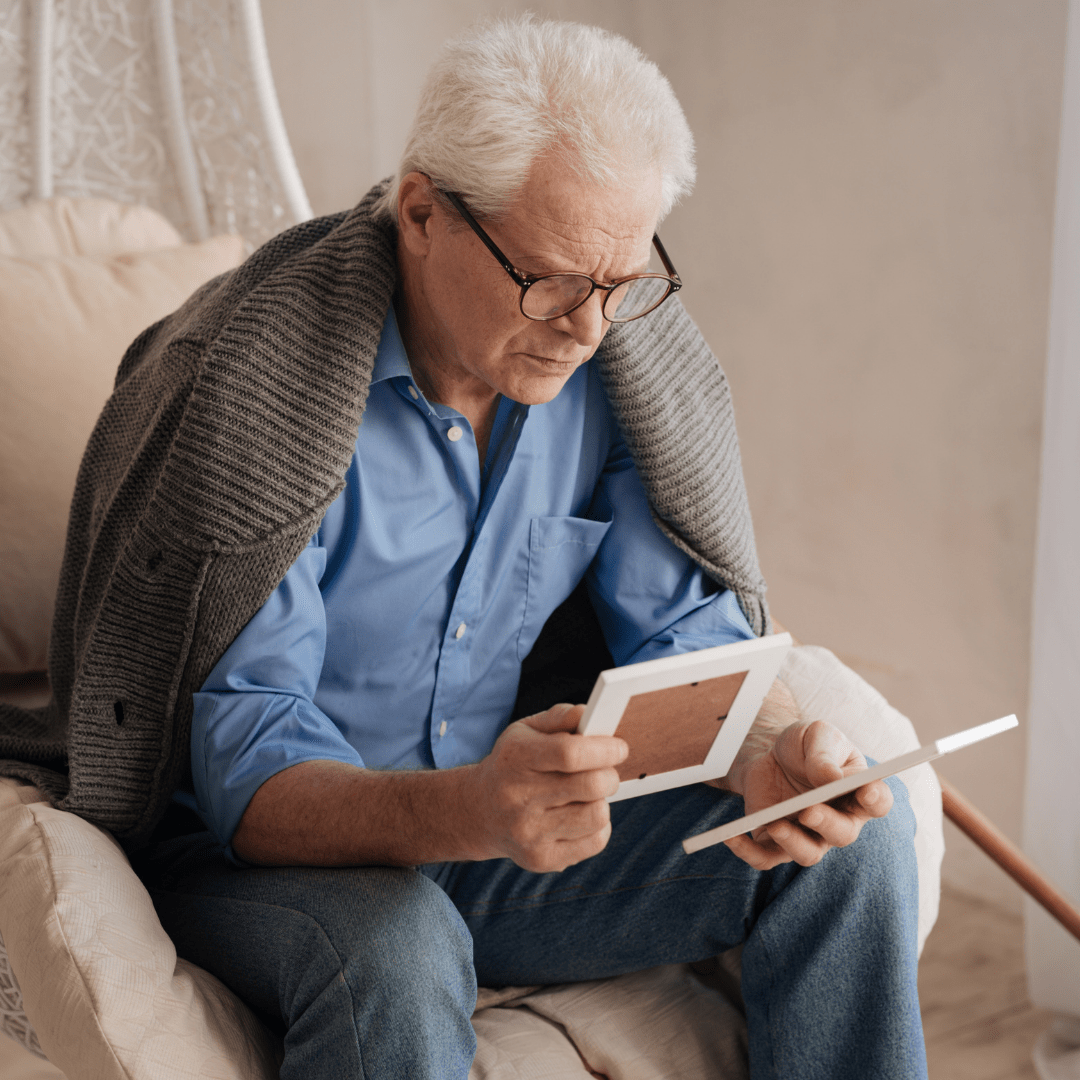

Fred and Ruby were financially struggling as timeshare owners. It seemed to be all for nothing too as they were not even given chances to make use of this so-called investment opportunity. They were left having to use other vacation alternatives, despite paying annual payments on a timeshare.

“It had been years since we actually had used our timeshare because we could never book anything with it. We were using hotels and other options when we vacationed and did that for years because we honestly didn’t think there was any way out of our timeshare. Then our friend told us about Wesley Financial Group, LLC and everything changed.”

We listened to Fred and Ruby’s timeshare story and knew right away they needed our help. After they qualified for our services, we wasted no time in ensuring that this couple became timeshare-free once again. So within just a year of working with us, Fred and Ruby’s timeshare agreement was canceled and they are no longer responsible for any more payments.*

If you know anyone with a similar timeshare experience, please feel free to pass our phone number along to them. We’d love to see if they qualify for our timeshare termination services.

*Wesley Financial Group, LLC (“WFG”) develops individualized programs for each client, terminates over 97% of their client’s timeshare relationships, and, in certain circumstances, obtains a refund of some or all of the timeshare purchase price. Actual results depend on each client’s distinct case and no specific outcome is guaranteed (although WFG does offer a 100% money-back guarantee if the timeshare is not canceled within the time specified in the WFG Enrollment Agreement).

Wesley Financial Group, LLC, and/or its affiliates, successors, or assigns are not lawyers and/or a law firm and do not engage in the practice of law or provide legal advice or legal representation. All information, software, services, and comments provided on this site are for informational and self-help purposes only and are not intended to be a substitute for professional advice, legal or otherwise.