“You bought it and signed the paperwork, so now you have to pay for it.” So many timeshare owners have heard this statement repeatedly. Derrick and his family told themselves this throughout the years of their timeshare ownership as well. What he didn’t expect was a second timeshare account billing statement some years later.

The following is a firsthand account about Derrick’s deceptive timeshare experience. We hope his story will help shed a light on the distrustful practices of the timeshare sales industry. Names have been changed or redacted due to privacy concerns.

The initial timeshare presentation when Derrick and his wife purchased their timeshare was painful enough. They’d dealt with many familiar issues related to their timeshare, including (but certainly not limited to) booking difficulties, limited availability, rising costs and less value. When he tried to work with the timeshare company’s customer service team, Derrick found his attempt to be useless in dealing with this timeshare madness.

“[The timeshare company] was a pain to deal with, and they changed their offer after I signed up. There was no help from their customer service. Every time and every way we tried to deal with them it was the same thing: “You bought it so now you have to pay for it”.

Derrick wanted to deal with this issue once and for all, so he attended a timeshare ‘owners update meeting’ to resolve the situation…or so he thought. Turns out, another timeshare company had bought and absorbed the company Derrick had purchased his timeshare through. He thought that his points purchase would eliminate the first timeshare account for his family, but the timeshare sales team had other plans in mind.

“They said we could trade our traditional timeshare for vacation points. This was true the first year, then [the new timeshare company] bought the property and refused to allow us to trade the week for points. This was a big deal to us, but the people I talked to about this wouldn’t accommodate in any way….one sales guy said, ‘Just buy more points.’”

Looking back, Derrick remembered thinking how purchasing the added points would allow them to fully utilize their timeshare option. He and his family were told by the timeshare company that this would be the best choice for them and that their fees wouldn’t rise significantly. Unfortunately, as with so many owners before them, Derrick and his family found these claims to be highly untrue.

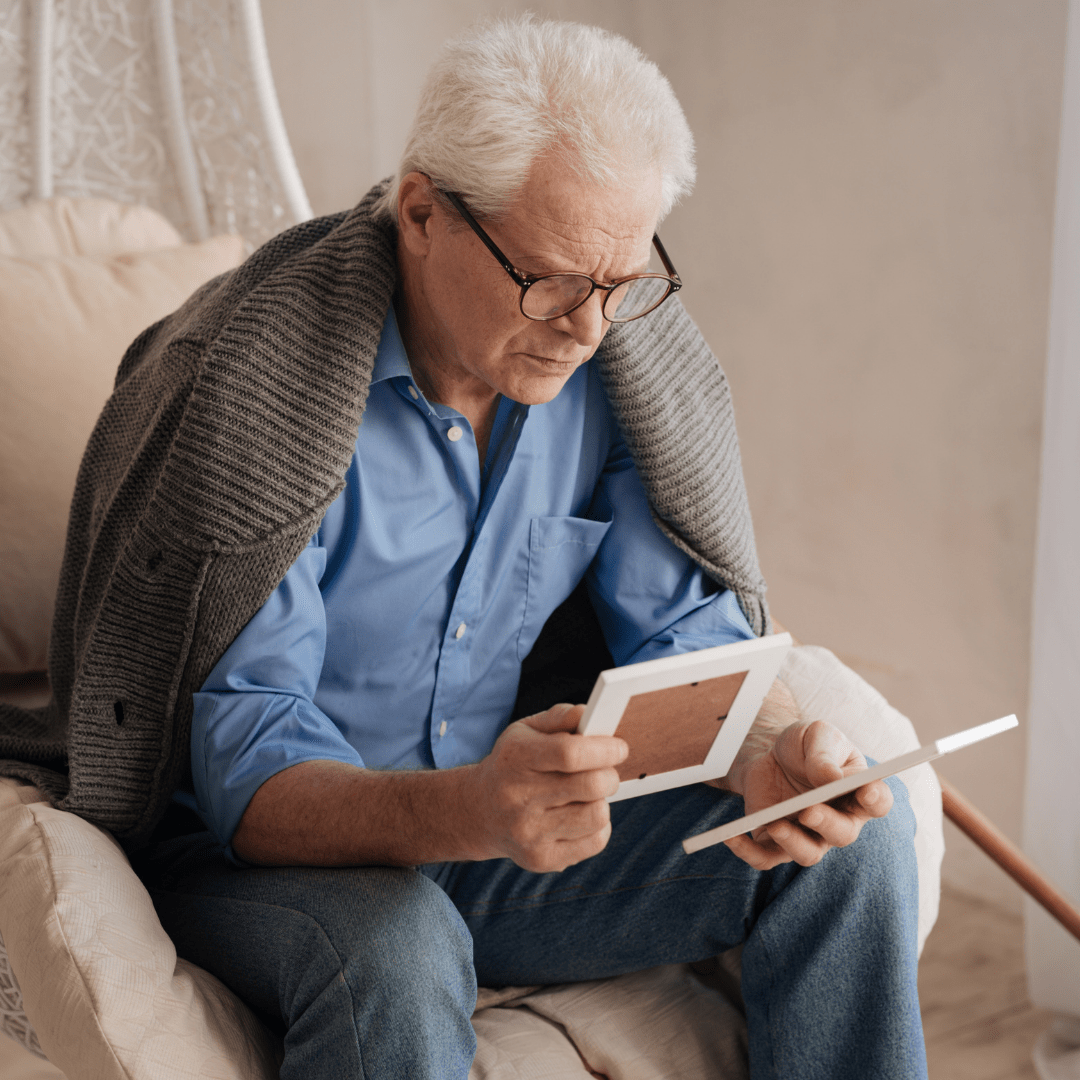

He had paid off the timeshare mortgages, but Derrick was ready to completely rid himself of his timeshares after years of dealing with terrible customer service and rising fees. Derrick’s wife had seen a commercial on television one day for Wesley Financial Group, LLC (WFG), so he decided to further research the company.

“We heard horror stories about people who paid up front, only to have nothing done on their behalf. One major thing we considered when finding help to get out of [the timeshare] was the cost, as well as if the exit company could handle the workload since we had two timeshares. The first people at WFG we talked with showed they truly cared about helping us with this problem.”

After several months of hard work on his part and with the assistance of WFG, Derrick and his family are now timeshare free! That’s right, WFG was able to help Derrick escape BOTH of his timeshares.* Derrick is now truly able to enjoy his vacations and time spent with his family without wasting approximately $2,000 per year on a timeshare he couldn’t use!

If you or anyone you know has experienced a similar situation with your timeshare company, please feel free to pass our phone number along to them. We’d love to see if you qualify for our timeshare termination services. Or you can click here to receive your own FREE Timeshare Exit Info Kit!

*Wesley Financial Group, LLC (“WFG”) develops individualized programs for each client, terminates over 97% of their client’s timeshare relationships, and, in certain circumstances, obtains a refund of some or all of the timeshare purchase price. Actual results depend on each client’s distinct case and no specific outcome is guaranteed (although WFG does offer a 100% money-back guarantee if the timeshare is not canceled within the time specified in the WFG Enrollment Agreement).

Wesley Financial Group, LLC, and/or its affiliates, successors, or assigns are not lawyers and/or a law firm and do not engage in the practice of law or provide legal advice or legal representation. All information, software, services, and comments provided on this site are for informational and self-help purposes only and are not intended to be a substitute for professional advice, legal or otherwise.