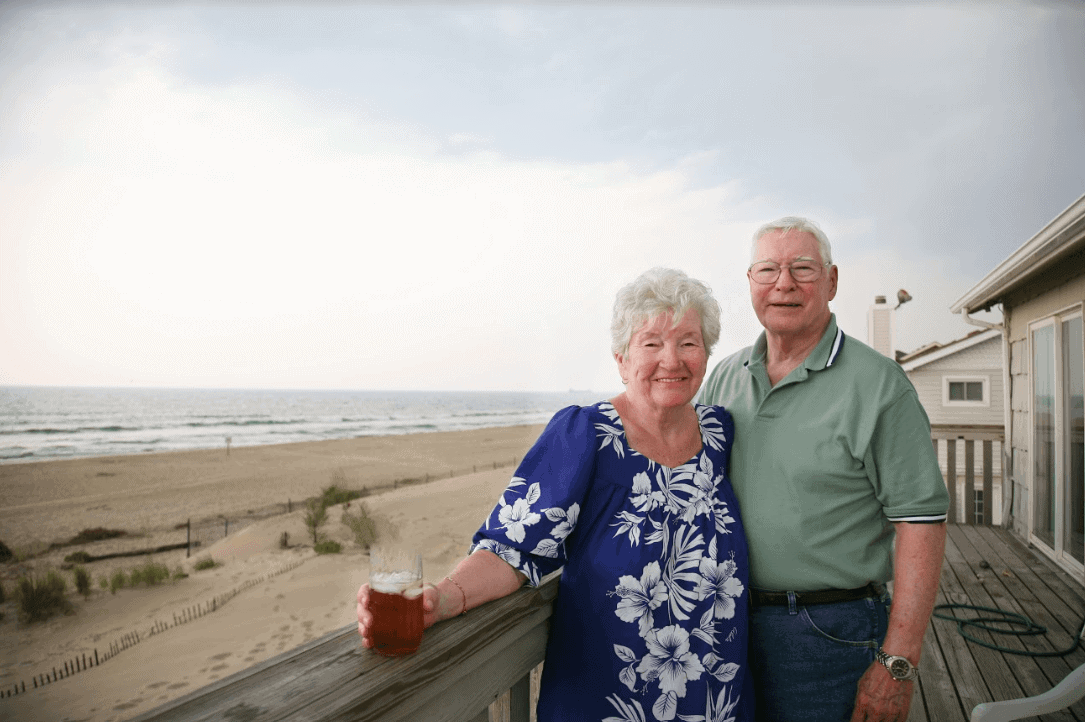

The loss of his wife of 21 years was the final straw for Kevin on wanting out of his timeshare, as he no longer had use for it and could not keep up with the escalating costs. Below is a written account from Kevin on his long-endured experience with the timeshare industry and how he was finally able to liberate himself from the financial crisis it brought into his life. Names of people and companies have been changed or omitted due to privacy concerns.

“The primary purpose of the timeshare originally was to cement my marriage agreement to spend quality vacation time together with my wife. Since her passing, I have no further use of the property and do not enjoy vacations alone. For years, I was tricked into constant upgrades by timeshare salespeople and now, I am left with something that takes up more than 50% of my income, and I never even use it.”

Kevin’s timeshare company has been bought out by several other timeshare companies over the years and each time he was encouraged to upgrade to a new package in order to take full advantage of the new accommodations.

“This all started when my wife signed us up for a free dinner and presentation event. Since then, we’ve been in numerous sales meetings that supposedly only last an hour but end up taking all day. Each time our company would get bought out, the new ownership would tell us that our current deals were essentially worthless unless we converted. Not only was the length of the presentations getting longer with each meeting, but the mortgage and maintenance costs were skyrocketing with every upgrade.”

Over 15 years, Kevin had amassed a total of four upgrades and invested over $100,000 since his initial timeshare purchase, all while also accumulating another $180,000 in timeshare debt.

“They want me to buy more and more until I can’t possibly afford it anymore and then they still try to sell me more! I have been trying to get out for years but was always fooled into upgrading, which never solved my problems. Finally, I listened to my mother and her financial advisor when they suggested I reach out to WFG.”

Kevin contacted us and within only six months we were able to terminate his timeshare and all the debt associated with it.* Free of this timeshare nightmare, Kevin now plans to focus his funds on his retirement savings and his church community.

If you know someone whose timeshare experience is similar to Kevin’s, please feel free to pass along our phone number below. We would be more than happy to see if they qualify for our timeshare termination services.

(800) 425-4081

*Wesley Financial Group, LLC (“WFG”) develops individualized programs for each client, terminates over 98% of their client’s timeshare relationships, and in certain circumstances, obtains a refund of some or all of the timeshare purchase price. Actual results depend on each client’s distinct case and no specific outcome is guaranteed (although WFG does offer a 100% money-back guarantee if the timeshare is not canceled within the time specified in the WFG Enrollment Agreement).