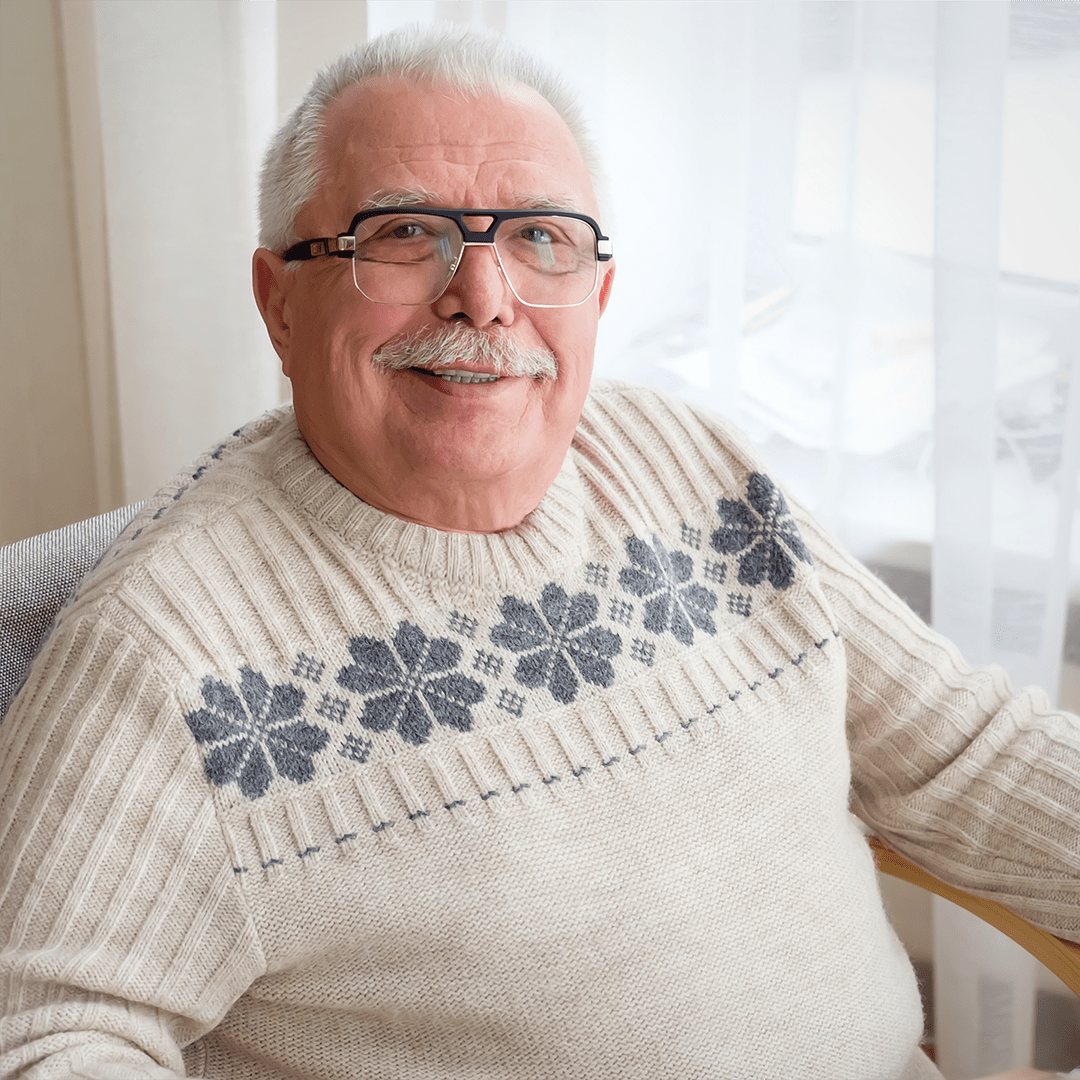

What started out as a trip to Phoenix in search of a vacation house for a newly retired couple, soon turned into a timeshare terror. Richard and Sandy have never considered themselves to be gullible people, but even they fell for deceptive tricks of the timeshare salespeople. As timeshare owners for nearly 20 years, they only had a small handful of vacations to show for it.

Below is a written account from Richard and Sandy on their personal experiences with their timeshare company, including why and how they got out of their agreement. We hope their story will inform you of some of the tactics used within the timeshare industry and how they are dangerous to good, unsuspecting people. Names and locations have been changed or omitted due to privacy concerns.

“Many years ago we were in Phoenix and considering the location for a retirement home so we were exploring the area. While staying at a resort, we signed up to attend a presentation when offered a $100 dining gift card to do so. All the time there was spent promoting this new resort currently under construction. They made it sound so beautiful and luxurious while pushing us to purchase.”

The couple later realized there were several misunderstandings in the communication with those salespeople. The signed paperwork did not match up with the verbal agreements that were made during the presentation, but it was too late to do anything about it.

“We were under the impression that we would own an annual week at this new resort, but instead it was a points system and our week was not guaranteed. There was hardly ever any availability at our resort, even when we would look out over a year in advance. We only had the chance to use the timeshare a few times in all of our years of owning. With our plan though, we could only get so many points which only afforded 2-3 days for trips when we were able to book.”

Despite their lack of usage at the timeshare, the couple remained owners and were responsible for annual fees whether they were using the property or not. This is what pushed them over the edge and why they began seeking a way out of the timeshare.

“Paying the increasing maintenance fees became such a terrible burden to bear and it was only getting worse. In more recent years, we have encountered personal medical issues that required more costs than expected and kept us from using the timeshare anymore.”

No longer even being able to visit the timeshare property, Roberto and Sandy did not see any reason they should have to keep paying maintenance fees. Seeing a television ad for Wesley Financial Group, LLC inspired them to give us a call and inquire about our termination services.

After owning their timeshare for close to 20 years, Roberto and Sandy are now finally free of their timeshare after working with us over the past year. While their unit was already fully paid off, they will no longer have to bear the stress of annual maintenance fees and can focus on a healthy retirement going forward.*

If you know anyone with a similar timeshare experience, please feel free to pass our phone number along to them. We’d love to see if they qualify for our timeshare termination services.

*Wesley Financial Group, LLC (“WFG”) develops individualized programs for each client, terminates over 97% of their client’s timeshare relationships, and, in certain circumstances, obtains a refund of some or all of the timeshare purchase price. Actual results depend on each client’s distinct case and no specific outcome is guaranteed (although WFG does offer a 100% money-back guarantee if the timeshare is not canceled within the time specified in the WFG Enrollment Agreement).

Wesley Financial Group, LLC, and/or its affiliates, successors, or assigns are not lawyers and/or a law firm and do not engage in the practice of law or provide legal advice or legal representation. All information, software, services, and comments provided on this site are for informational and self-help purposes only and are not intended to be a substitute for professional advice, legal or otherwise.