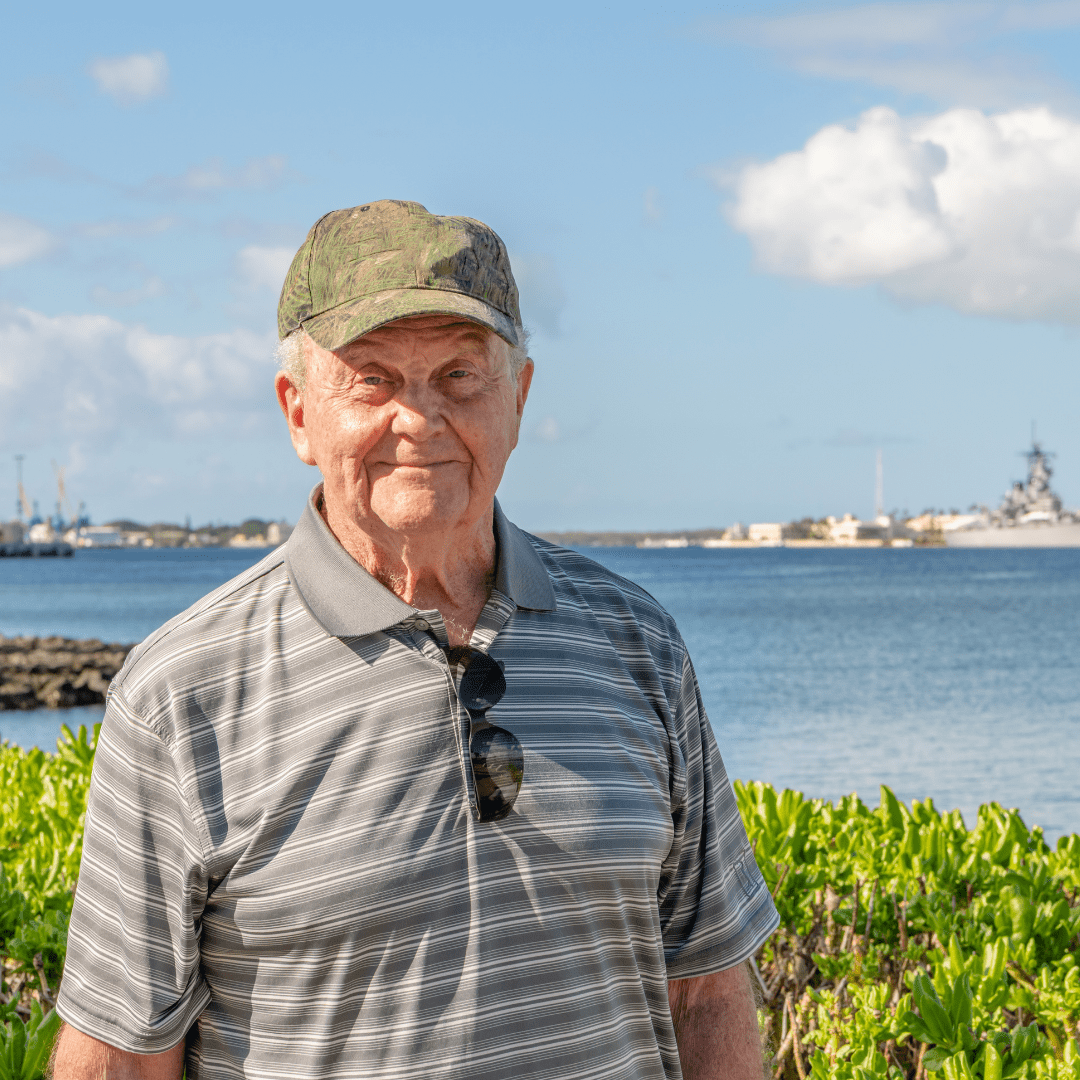

Victor and Lacey’s timeshare resort never seemed to care for the couple, other than when they wanted to sell them something. The salespeople were aware that Lacey had recent health issues that would make traveling less than ideal for this family. Knowing this, the timeshare purchase was still heavily pushed onto the couple.

Since owning the timeshare property, only more stress was brought into Victor and Lacey’s lives. It was also affecting their finances, and not in a good way. Hear firsthand from the couple on how they were able to escape this terrible situation. Here’s a hint, they had help from one of the leading timeshare exit companies in the industry. In the story below, we have changed or omitted the name of companies and people due to privacy concerns.

“The only reason we were even there in the first place is that we won a free cruise trip and with it, we had to sit through a timeshare presentation. We had no idea they were going to pressure us so much into buying a timeshare. This was our first time learning about them!”

Learning about what a timeshare is and buying one on the same day is not a good practice. Especially, when the teacher and the seller are the same people. Timeshare salespeople are quite known to tell you whatever you need to hear to get you to buy their timeshare properties.

“They told us a timeshare would be perfect for us since we were retired. We let them know, though, that my wife, Lacey, had a health condition that did not allow us to travel very often. I explicitly told them traveling every year was out of our reach. They assured us that we would only have to make payments on the years that we used the timeshare…”

Fast forward five years later and Victor and Lacey had only used the timeshare once, while still being charged for the mortgage, maintenance, and various other assessment fees every single year. This was not the only lie that was told by those salespeople.

“Something else we specifically remember them saying was once the timeshare mortgage was completely paid off, the maintenance fees would end also. Well, turns out that was not true at all, and we actually risked these fees being inherited by our children when we passed. This thought alone caused us many sleepless nights.”

Victor and Lacey were already being pushed around by their timeshare resort, but now their children were being threatened. This did not sit well with the family, and they knew it was time to make a change.

“We already reached out to our resort about selling our timeshare property but they were no help. We started researching and looking for help ourselves and that’s when we found out about WFG. They were a blessing to work with and wasted no time helping us get out!”

Wesley Financial Group, LLC took in Victor and Lacey and guaranteed them they would terminate their timeshare agreement. Half a year later and this dream was true! Not only that, but the couple also was relieved over $40,000 in timeshare mortgage and maintenance debt.*

“Now we don’t have to worry about the stress of a timeshare during our retirement. We can focus on ourselves and our health. Much better than wasting our money!”

If you know anyone with a similar timeshare experience, please feel free to pass our phone number along to them. We’d love to see if they qualify for our timeshare termination services.

*Wesley Financial Group, LLC (“WFG”) develops individualized programs for each client, terminates over 97% of their client’s timeshare relationships, and, in certain circumstances, obtains a refund of some or all of the timeshare purchase price. Actual results depend on each client’s distinct case and no specific outcome is guaranteed (although WFG does offer a 100% money-back guarantee if the timeshare is not canceled within the time specified in the WFG Enrollment Agreement).

Wesley Financial Group, LLC, and/or its affiliates, successors, or assigns are not lawyers and/or a law firm and do not engage in the practice of law or provide legal advice or legal representation. All information, software, services, and comments provided on this site are for informational and self-help purposes only and are not intended to be a substitute for professional advice, legal or otherwise.