The following includes quotes from Stacy in regards to her experience with a timeshare sales team. The names of people and companies have been changed or removed due to privacy concerns.

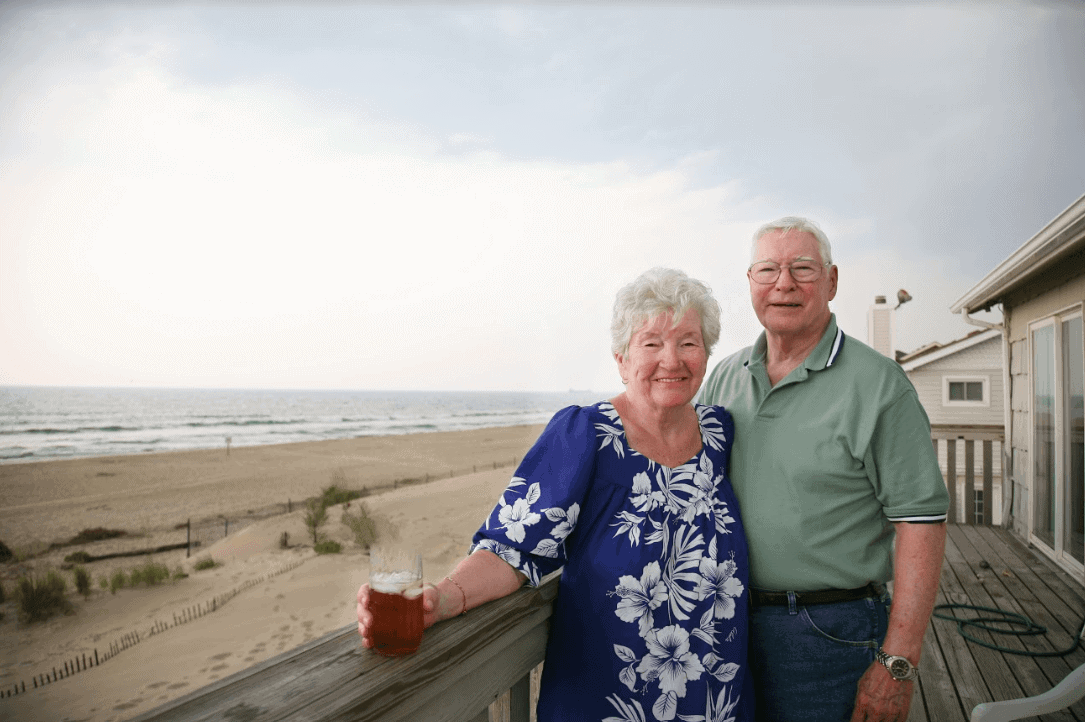

“When I first purchased a timeshare, I only purchased for the ability to use it every other year. That was working for me and the cost was affordable. I figured I would be able to take more vacations anytime that I wanted, being that I was a teacher and had plenty of time off. I had the timeshare for several years and each time I would visit a resort I was always invited to attend a meeting on the pretense that I would get new information on how the timeshare works and how I could best make it work for me. Each time I went I was always asked to buy into more points.”

Stacy was not easily persuaded into upgrading her timeshare agreement, but she finally gave into the pressure that the sales team casted on her. They were relentless into trying to convince her this was the only way she’d still be able to benefit from having a timeshare. She gives an in-depth explanation of just how she was pushed into upgrading below:

“When I upgraded the timeshare I would say that I had “a smooth talker” and he told me that the original contract/points agreement that I had was old and that it would be harder for me to make reservations because the contracts had changed. He assured me that purchasing more points would keep me being able to make reservations when I wanted. Although I kept saying that I did not have a problem with what I had, he kept telling me that my current contract was not benefiting me. He had several people, including a manager (I guess that was his position) come over and talk to me and tell me how my old contract was not being offered anymore, and that makes it harder to get the reservations that I would want when I wanted. After several long hours, and talking to several sales reps, I was persuaded that upgrading would be better for me… so I upgraded.”

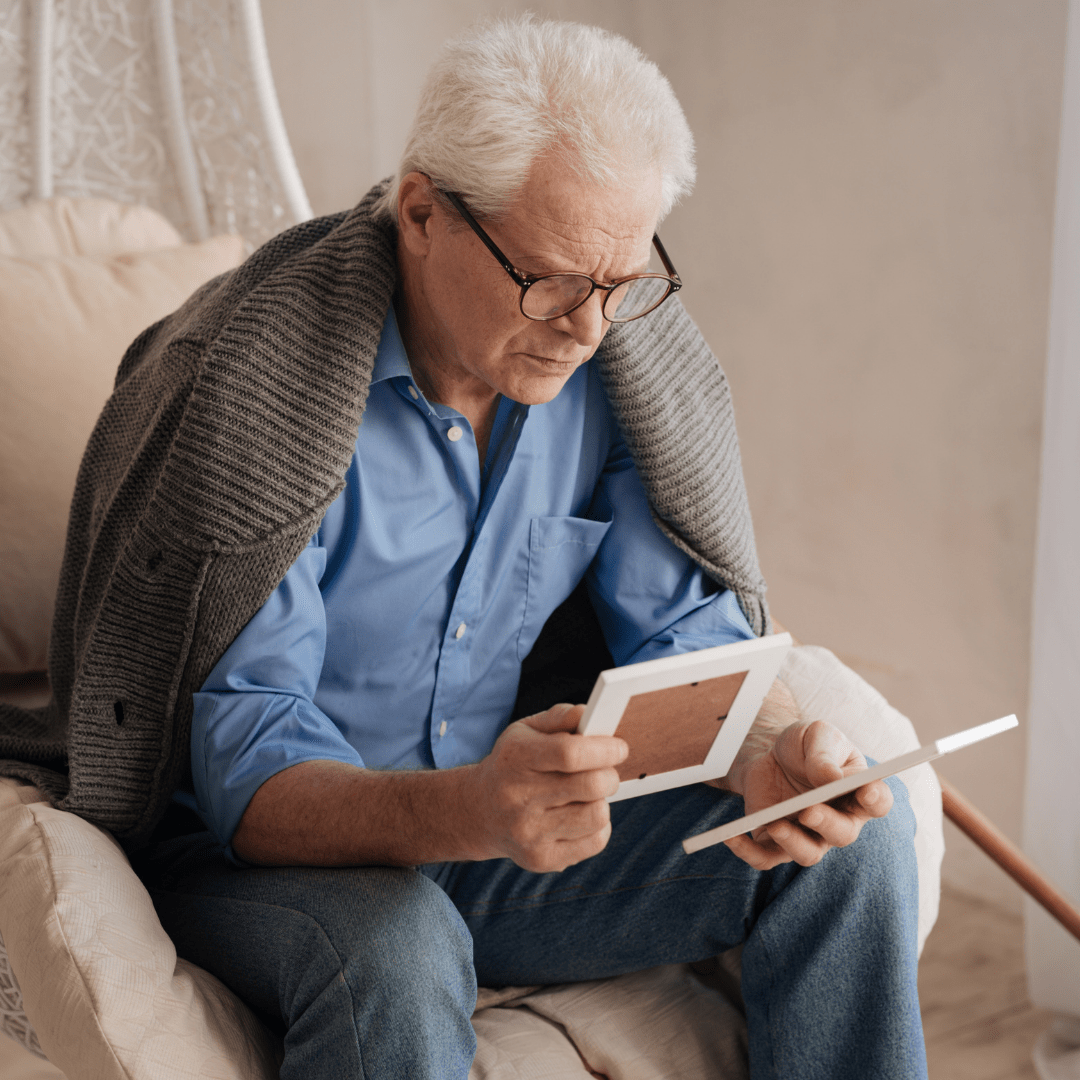

It didn’t take long for Stacy to see just how bad she had been lied to. Her fees were rising and the availability of her timeshare was diminishing.

“I am unable to maintain the payments because they are so high. I am usually a month behind and they constantly call – even if you are one day late. I am unable to get reservations when I want, especially within weeks. Sometimes I cannot plan to go on vacation until a few weeks before, and I can NEVER get into a resort. I have even tried to make hotel reservations and have been told that I have to make the reservation 90 days in advance, which is impossible in most cases.”

Stacy felt her timeshare was useless. And even though now she was contributing more money to it, she couldn’t contribute nearly as much as she used to a few years ago. That’s when she reached out to our team at Wesley Financial Group, LLC.

“I’m so grateful for Wesley. Overall I’m just happy to have my financial freedom back. It helps me sleep at night to know I can help my family with their important financial needs again.”

We are pleased to announce that after signing on with our team we were able to terminate Stacy’s timeshare agreement.* She looks forward to vacationing in the future without having to worry about attending any presentations.

If you know someone who’s in timeshare distress and could use our legitimate services, pass along our phone number below. We would be more than happy to see if they qualify for our timeshare termination services.

(800) 425-4081

*Wesley Financial Group, LLC (“WFG”) develops individualized programs for each client, terminates over 98% of their client’s timeshare relationships, and in certain circumstances, obtains a refund of some or all of the timeshare purchase price. Actual results depend on each client’s distinct case and no specific outcome is guaranteed (although WFG does offer a 100% money back guarantee if the timeshare is not cancelled within the time specified in the WFG Enrollment Agreement).

Wesley Financial Group, LLC, and/or its affiliates, successors, or assigns are not lawyers and/or a law firm and do not engage in the practice of law or provide legal advice or legal representation. All information, software, services, and comments provided on this site are for informational and self-help purposes only and are not intended to be a substitute for professional advice, legal or otherwise.