“It got to the point where I was paying over $1,000 a month for our timeshare. I was always stressed paying this every month along with the house mortgage and still providing for my family. And the worst part was not being able to use the timeshare even though I was paying for it.”

When Amy approached us looking for assistance in getting out of her timeshare agreement, we worked quickly with her to see it come to fruition. The following is a written account from her on how she was deceived by the timeshare industry before calling Wesley Financial Group, LLC. The names of people and places have been changed and/or redacted for privacy reasons.

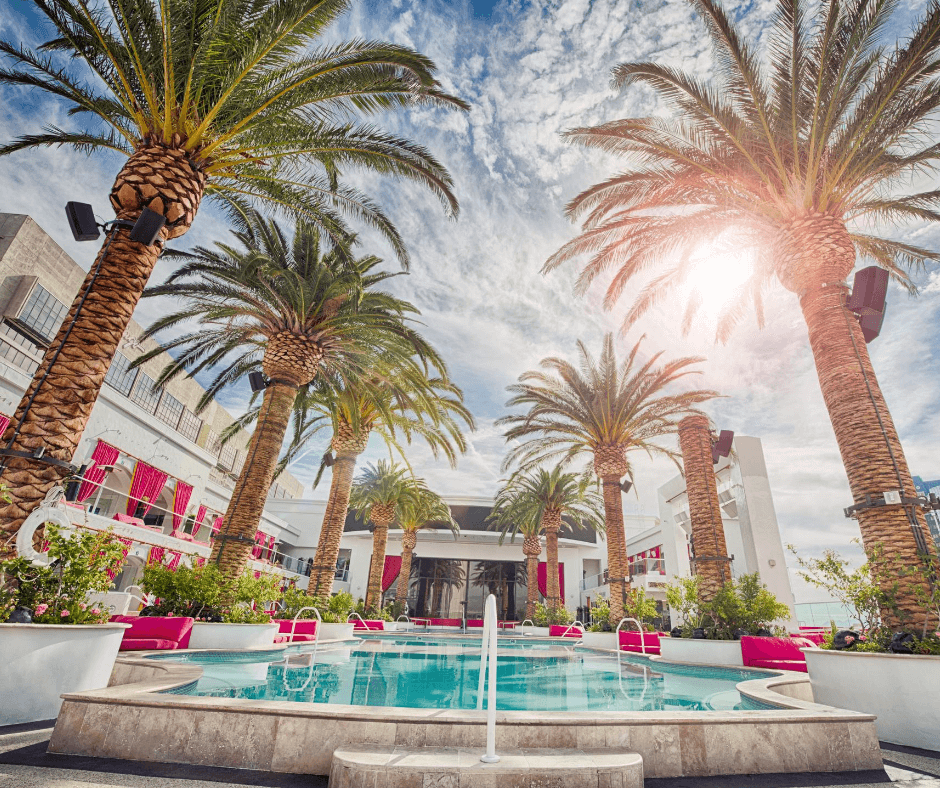

“I always felt so pressured whenever I would go to their presentations, and I went to a lot of them. During the first one, I was kept in the room for 6 hours before I agreed to buy a timeshare. But I had a lot of issues with it, the main one being that I could never make any reservations at MY timeshare. It just didn’t make any sense.”

Once Amy began voicing her valid complaints to her timeshare company, it wasn’t long before she found herself in a constant cycle of upgrades.

“Whenever I was having trouble using my timeshare, they made me believe that an upgrade would solve all my problems. I tried upgrading several times, but it never got better. One time they even told me I could use my points for Disney World or Universal Studios if I upgraded.”

How do you think that deal worked out for Amy? Based on most timeshare company’s track records, she didn’t get to visit Disney with her family.

“How can I go to Disney World if there are never any open reservations. I had upgraded my timeshare five times and booking trips never got easier. My family and I never got to visit the places we wanted to with our timeshare. It was not worth anything close to what I was paying, practically worthless.”

After owning her timeshare for well over a decade and having countless upgrades along the way, Amy found herself with quite a bit of timeshare debt from the expensive mortgage and maintenance fees. When she saw one of our television ads, she thought it was worth a shot.

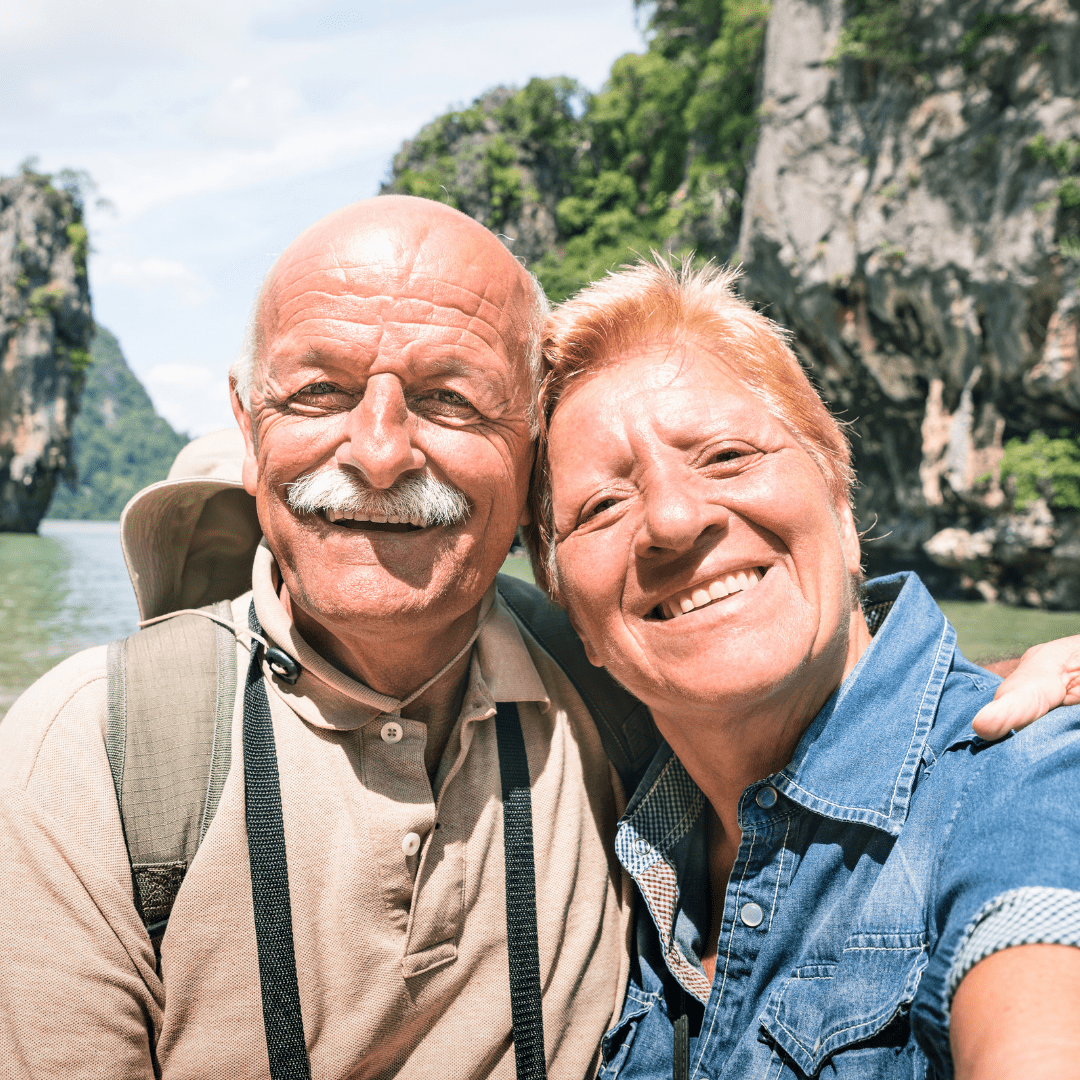

Since reaching out to Wesley Financial Group, LLC, Amy has seen her timeshare agreement officially terminated and been relieved of more than $49,000 in debt.* Gone are the days of stress and headaches for Amy when she travels with her family.

If you have ever experienced a similar situation with your timeshare, please do not hesitate to call us at the number below. You may qualify for our timeshare termination services.

*Wesley Financial Group, LLC (“WFG”) develops individualized programs for each client, terminates over 98% of their client’s timeshare relationships, and, in certain circumstances, obtains a refund of some or all of the timeshare purchase price. Actual results depend on each client’s distinct case and no specific outcome is guaranteed (although WFG does offer a 100% money-back guarantee if the timeshare is not canceled within the time specified in the WFG Enrollment Agreement).

Wesley Financial Group, LLC, and/or its affiliates, successors, or assigns are not lawyers and/or a law firm and do not engage in the practice of law or provide legal advice or legal representation. All information, software, services, and comments provided on this site are for informational and self-help purposes only and are not intended to be a substitute for professional advice, legal or otherwise.