With three kids, Beth leaped at the chance for a reduced vacation that was a two day, one night stay and a cruise to the Bahamas. The timeshare sales people told her that the “no obligation presentation” would only last about 1.5 hours.

The following is a written account of how Beth C. was deceived into making a timeshare purchase. Names of people have been changed and/or redacted for privacy reasons.

“The sales presentation was about 3 hours long. We were told about how great it would be to be ‘owners’ of this timeshare and how it can be passed down to our kids. What we were never told was how much the maintenance fees would increase each year or how it would actually be a liability to our kids.”

The family ultimately signed up for a Yacht Club-style timeshare club, thinking that they would use it for their deep sea fishing vacations in Florida. Beth and her family used the timeshare a few times throughout the two decades of ‘ownership’ before she realized just what she had gotten into.

“We enjoyed it the first 3 years or so (when the building was new) and did one trip deep sea fishing. After some changes in their inventory, we were never able to go deep sea fishing. We went to our resort on alternate years at first, but after about five years, I looked into getting out of the timeshare. We looked online and saw so many timeshare ‘options’ that were selling for ONE DOLLAR!”

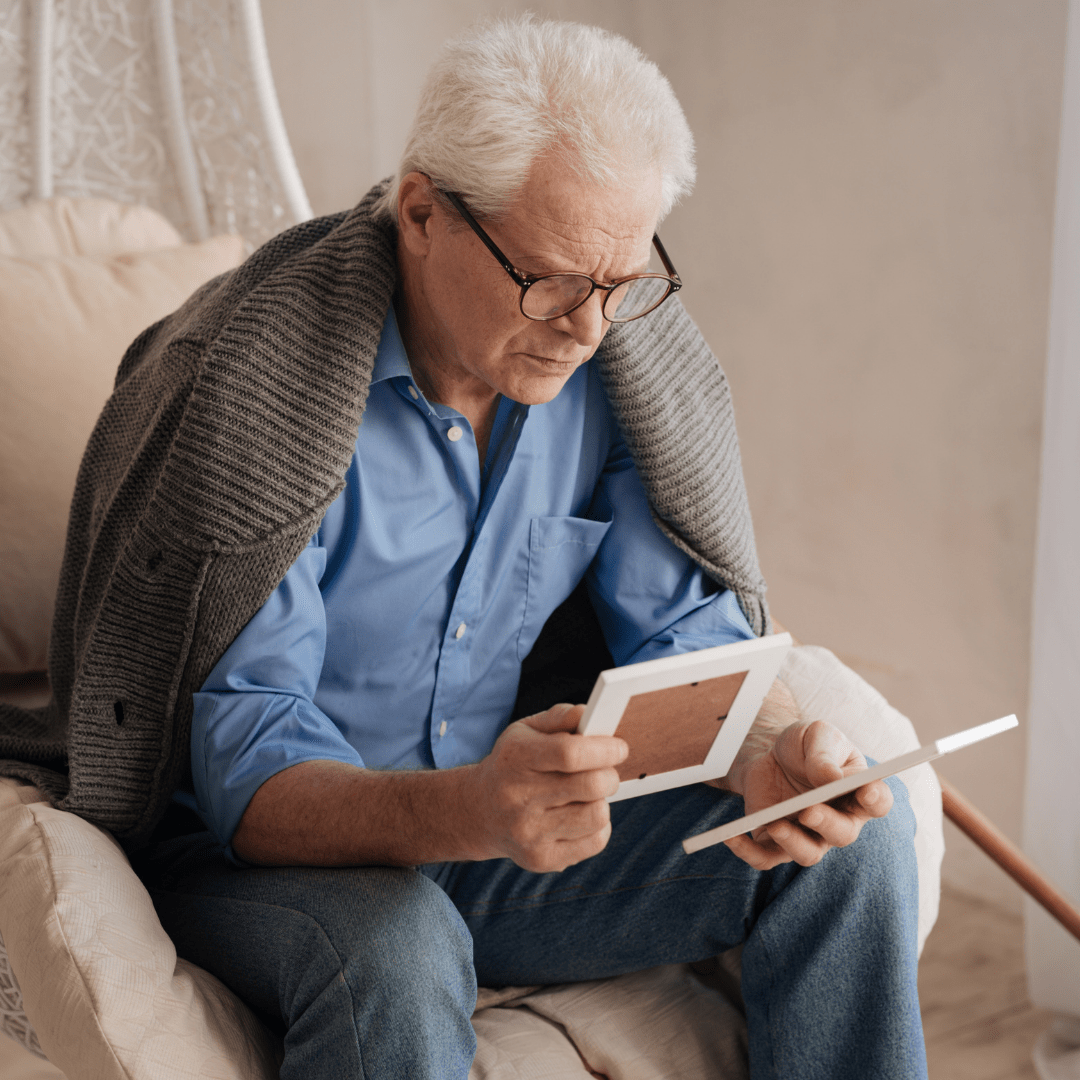

As her health began to decline throughout the years, Beth and her family were forced to look further into selling her timeshare.

“I’ve had back surgery and hip replacement, both, in the past 10 years. I have since retired and bring home less money, yet the maintenance fees keep increasing and I can’t realistically see it costing THAT much. Even the cost of living is not increasing to that amount each year!

I haven’t used this timeshare enough to warrant the nearly $27,000 I have invested in it over the years. Being retired limits my spending and also affording any vacations.”

After finally deciding to do some research, she contacted us here at Wesley Financial Group, LLC, (“WFG”) to help cancel her timeshare and she is now living timeshare-free while saving nearly $1,400 per year!*

Are you or someone you know stuck in a similar situation as Beth? If so, please feel free to contact us here at WFG. We would love to see if you or a friend qualify for our timeshare termination services!

*Wesley Financial Group, LLC (“WFG”) develops individualized programs for each client, terminates over 98% of their client’s timeshare relationships, and, in certain circumstances, obtains a refund of some or all of the timeshare purchase price. Actual results depend on each client’s distinct case and no specific outcome is guaranteed (although WFG does offer a 100% money back guarantee if the timeshare is not cancelled within the time specified in the WFG Enrollment Agreement).

Wesley Financial Group, LLC, and/or its affiliates, successors, or assigns, are not lawyers and/or a law firm and do not engage in the practice of law or provide legal advice or legal representation. All information, software, services, and comments provided on this site are for informational and self-help purposes only and are not intended to be a substitute for professional advice, legal or otherwise.