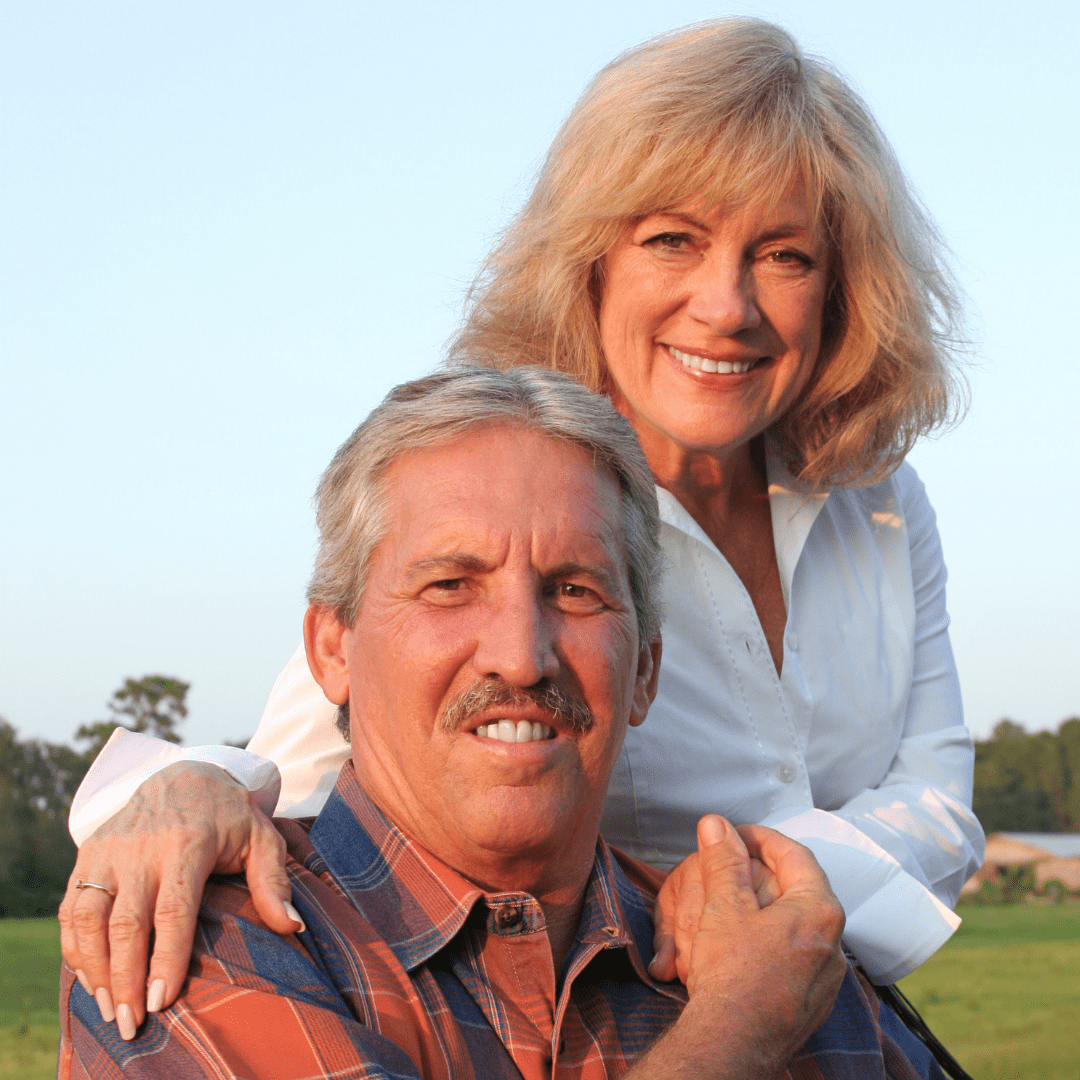

Why should you be stuck with something you never even wanted in the first place? For Carolyn and Allen, that is an experience they are all too familiar with. When the timeshare salespeople wouldn’t take no for an answer, this couple found themselves as owners of a property with increasing rates that they couldn’t keep up with.

Below is a written account from Carolyn and Allen on how they ended up in this timeshare mess and how they were eventually able to free themselves from it. Names of people and places have been changed and/or redacted for privacy reasons.

“They gave us a free two-night stay at their resort and several free tickets to shows happening in the city that weekend if we would attend their 45-minute presentation. While there, we felt pressured by the first sales rep and when we kept saying no, they would just bring in more high-pressured salespeople. They had arranged for us to be picked up from the airport and brought there, so we really had no option to leave. They kept us there for three hours.”

Timeshare salespeople know how to set the scene, and what they like to do is create an environment that puts clients in a compromised position when it comes to decision making. But when these deceptive tricks don’t work, oftentimes they tend to fall back to just deliberately lying.

“While at the presentation, they told us three lies. The first one was that we could use our timeshare anytime to go anywhere. That is not true because every time we tried to book a trip, there was never anything available. The next lie, they said it would be a financial investment for us because we could sell it or rent it. Whenever we reached out to the company to do so, they would tell us they can not sell or rent our unit. And the final lie was that we’d be able to leave this to our children at no cost. I guess they didn’t consider the mortgage and maintenance fees as costs.”

Lie after lie and payment after payment, that is all Carolyn and Allen ever received from their timeshare company.

“The timeshare has become a financial burden for our whole family. Whenever we reach out for help, they just push us to pay more and then try to get us to give them names for people who may want to purchase a timeshare. They’re terrible.”

While their timeshare company did not offer much assistance to Carolyn and Allen, Wesley Financial Group, LLC (“WFG”) was happy to help when they reached out to us. We recently just closed on their timeshare termination, lifting the financial burden and relieving them of $5,000 in timeshare mortgage debt.*

Are you in need of our timeshare termination services? Call us at the number below today to see if you qualify!

*Wesley Financial Group, LLC (“WFG”) develops individualized programs for each client, terminates over 98% of their client’s timeshare relationships, and, in certain circumstances, obtains a refund of some or all of the timeshare purchase price. Actual results depend on each client’s distinct case and no specific outcome is guaranteed (although WFG does offer a 100% money-back guarantee if the timeshare is not canceled within the time specified in the WFG Enrollment Agreement).

Wesley Financial Group, LLC, and/or its affiliates, successors, or assigns are not lawyers and/or a law firm and do not engage in the practice of law or provide legal advice or legal representation. All information, software, services, and comments provided on this site are for informational and self-help purposes only and are not intended to be a substitute for professional advice, legal or otherwise.