When Jordan was first introduced to timeshares, he was being pressured to buy one. He was stuck in a four-hour presentation with several different salespeople, until he would finally agree to one of their deals. The salespeople went as far as to follow Jordan out to his car to make sure he was getting his checkbook and not just leaving. You can only imagine how this all turned out for the new timeshare owner.

Jordan felt pressured from the very beginning. Hear his side of the story today through the written excerpts below. A timeshare victim, Jordan, details his experience with the salespeople of these resorts and how they misled him into a deal he had no interest in. Names of companies and people have been changed or omitted due to privacy concerns.

“I was misled from the beginning! My first encounter with them was being offered a $100 gift card to go and listen to their vacation presentation. They talked for hours about all the great things about timeshares and made it seem like it was the greatest deal ever. They even told me I could pass down my timeshare to my children at no cost. They never even mentioned the maintenance fees!”

There was a lot that the timeshare salespeople did not tell Jordan that day. Such as the true costs of the timeshare or how awfully difficult it would be to use. As a timeshare owner, it should be quite easy to book a vacation, but not for Jordan. He constantly had issues and voiced his concerns to the resort representatives, but that somehow only made things worse.

“I went to the resort for what was supposed to be a meeting about the problems I was having in using their services. What it turned out to be was another sales pitch. They said I had to upgrade to a higher tier and everything would be fixed. I insisted that I was not receiving the services that I was promised at the original purchase. For the upgrade, they were asking for more money than what I paid the first time.”

Timeshare upgrades are often pushed onto unhappy owners who are having issues with their timeshare property. The salespeople make the upgrades out to seem like something that will fix everything but in reality, that is not the case. Oftentimes, these upgrades make no difference other than doubling the expenses.

“This timeshare just caused such a huge financial hardship for me. The upgrade never made things easier. It just put me further in debt. After this, I was helpless in getting any assistance from the resort. The only time I would hear back from them was when I had a bill due.”

Jordan’s situation had only worsened and he was plunging further into debt and at a fast pace.

“Only one vacation a year is not worth the true cost of a timeshare, but I wasn’t even able to vacation once with it! That resort was just taking my money!”

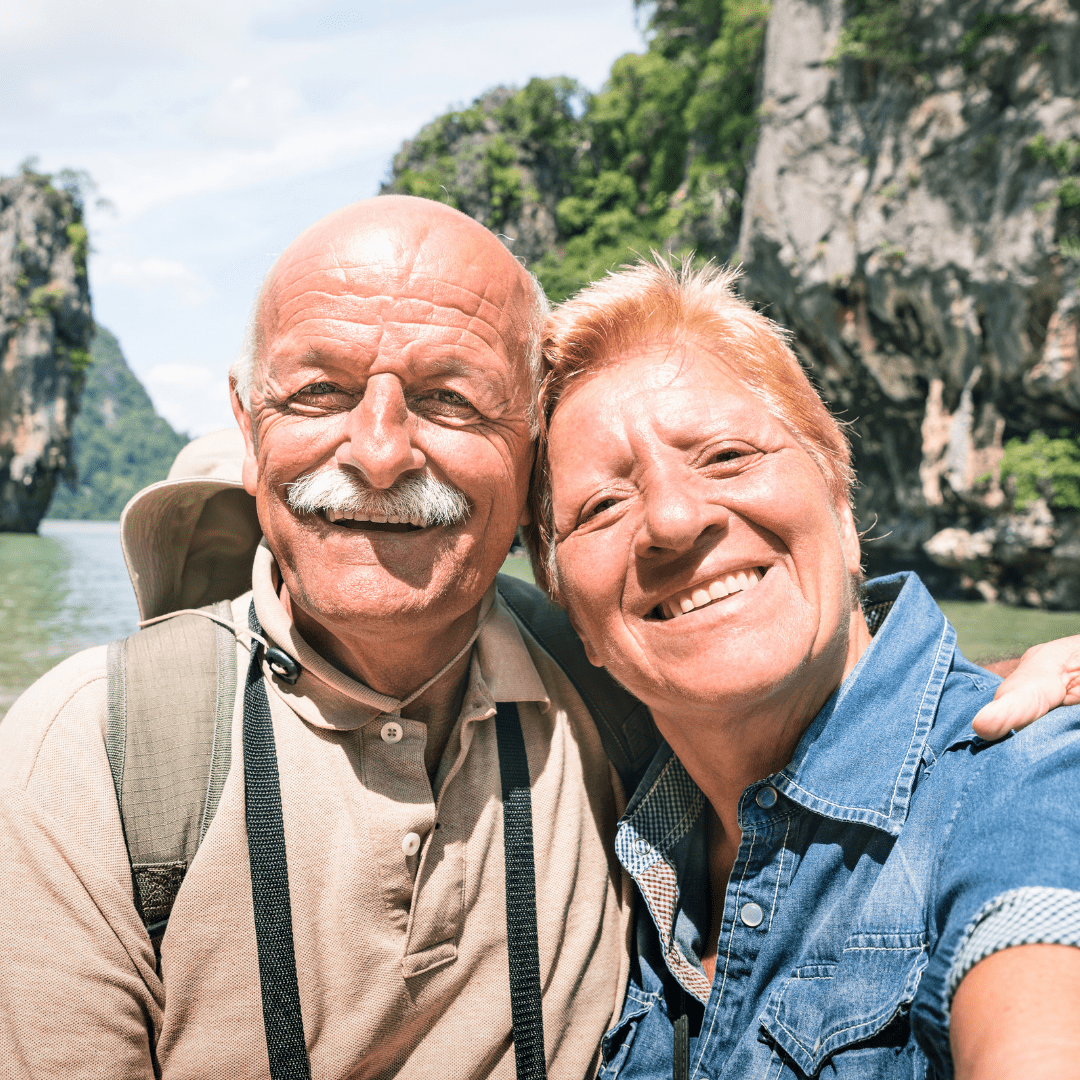

After about five years, Jordan was deep into debt with his timeshare company. He knew he could not keep this up, but the resort offered little to no help. That’s when Jordan picked up his phone and called Wesley Financial Group, LLC. He had heard a few of our ads on the radio but was hesitant to call at first. Looking back now, he wishes he would have picked up the phone earlier.

That’s because we were able to quickly help Jordan with his situation and before too long, we had his timeshare agreement completely terminated! On top of that, he was also relieved of $28,000 in timeshare mortgage debt.* Needless to say, Jordan was very happy to see this day come.

If you know anyone with a similar timeshare experience, please feel free to pass our phone number along to them. We’d love to see if they qualify for our timeshare termination services.

*Wesley Financial Group, LLC (“WFG”) develops individualized programs for each client, terminates over 97% of their client’s timeshare relationships, and, in certain circumstances, obtains a refund of some or all of the timeshare purchase price. Actual results depend on each client’s distinct case and no specific outcome is guaranteed (although WFG does offer a 100% money-back guarantee if the timeshare is not canceled within the time specified in the WFG Enrollment Agreement).

Wesley Financial Group, LLC, and/or its affiliates, successors, or assigns are not lawyers and/or a law firm and do not engage in the practice of law or provide legal advice or legal representation. All information, software, services, and comments provided on this site are for informational and self-help purposes only and are not intended to be a substitute for professional advice, legal or otherwise.