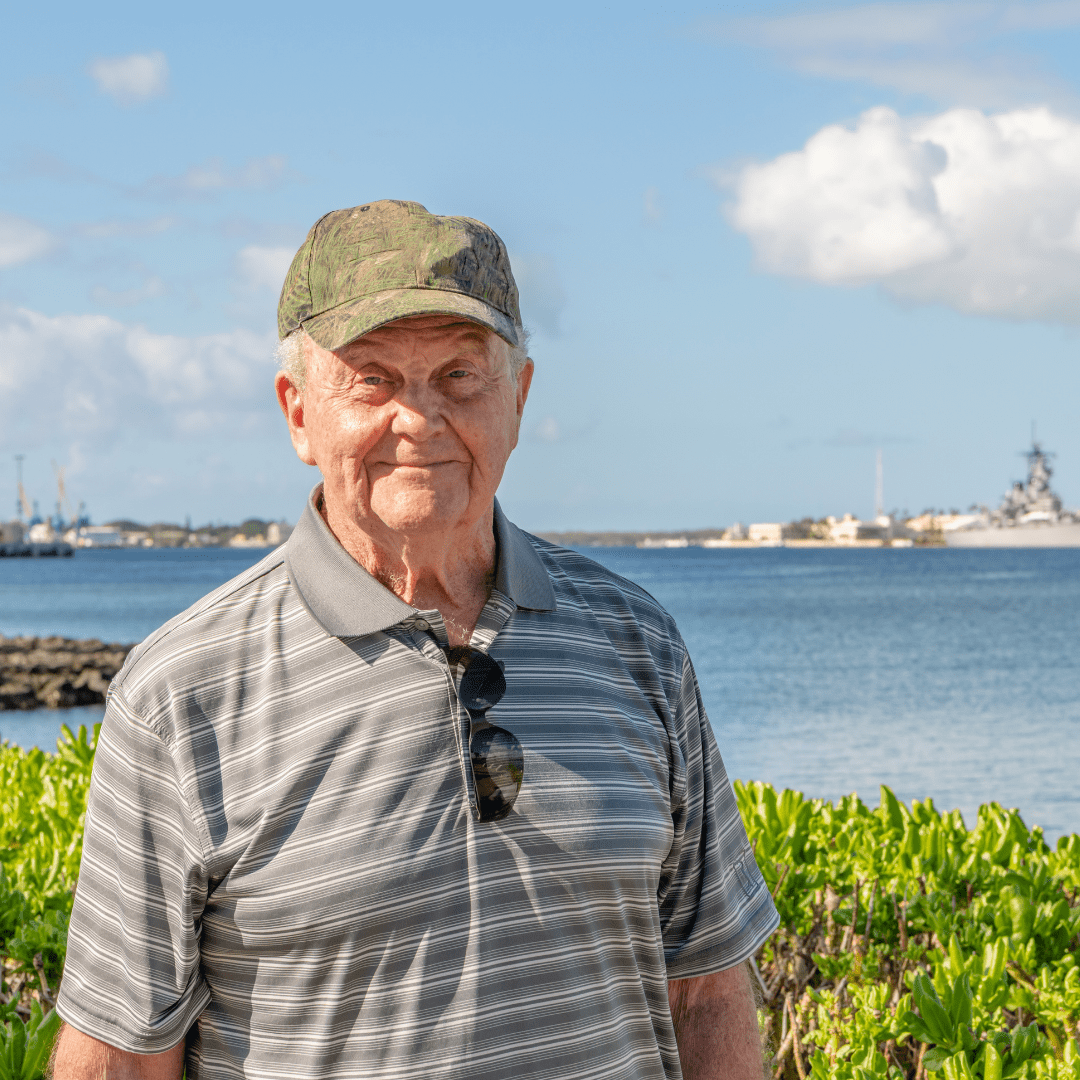

Seeking a relaxing escape from their home in the frigid north, Bradley and his wife were simply enjoying a trip in Hawaii when they were approached with the prospect of free tickets to a luau. What happened next would lead to financial turmoil for the couple over the next decade, which included surging maintenance fees and even being threatened with debt collectors.

Below includes written accounts from Bradley concerning his experience and we hope it will help shed some light on the sales tactics used by timeshare salespeople to mislead customers. The names of people and companies have been changed or removed due to privacy concerns.

“In 2008 we had an amazing opportunity to travel to Hawaii which was a great chance for a retreat from our snowy home up north. While in search of fun activities for our time there, we went to the visitor’s center to purchase tickets for a luau event. Here we were persuaded into attending a timeshare presentation in exchange for free tickets to the said luau.”

Following their trip to Hawaii, Bradley and his wife soon discovered that this timeshare purchase would be extremely challenging for them as it had such a limited number of locations and the only availability being years out. Over the next 12 years, they could only manage to make use of their timeshare for their family on just two separate occasions. Over time, Bradley realized several ways he had been manipulated in that timeshare presentation.

“Our maintenance fees were reasonable at first, but they quickly began to escalate and it felt like I was just pouring money into a hole. We were told that it would be possible to sell points to our friends and family and that this would help to pay our maintenance fees. We were also encouraged to sign up for a credit card at a local bank in Hawaii. We were told the use of it would lead to more points for our timeshare. All of this, and the fees, continued rising sky high and we soon began struggling to stay afloat.”

After years of watching these maintenance fees rise drastically and having a negative effect on their personal lives, Bradley knew he needed to start looking for a way out of this timeshare.

“At one point we were struggling so much that we fell behind on our payments, and the first notice we received were threats of debt collectors showing up at our doors if we did not pay up. This led to us having to borrow funds to bring everything up to date, and I could feel that hole of money getting deeper and deeper.”

In searching for ways to cancel his timeshare, Bradley came across our Facebook ads and was instantly intrigued by the professionalism shown by our representatives.

“Based on all the helpful information and personal testimonials from their website, Wesley Financial Group was an easy decision for me to make. I have enjoyed speaking with all the knowledgeable representatives there and they were very easy to work within canceling our timeshare.”

We were able to assist in terminating Bradley’s timeshare and liberating him of $40,000 in timeshare mortgage debt.* He now is anticipating the future stress-free vacations he’ll be able to take with his wife and family.

If Bradley’s timeshare experience sounds similar to yours, please feel free to give us a call at the phone number below. We’d be happy to see if you qualify for our timeshare termination services.

(800) 425-4081

*Wesley Financial Group, LLC (“WFG”) develops individualized programs for each client, terminates over 98% of their clients’ timeshare relationships, and in certain circumstances, obtains a refund of some or all of the timeshare purchase price. Actual results depend on each client’s distinct case and no specific outcome is guaranteed (although WFG does offer a 100% money-back guarantee if the timeshare is not canceled within the time specified in the WFG Enrollment Agreement).