Table of Contents

Understanding Timeshare Units: What They Are and How They Operate

Let’s start with the basics…

What Is a Timeshare?

A timeshare is a vacation ownership product in which multiple parties share ownership of a vacation property. Timeshare resorts are usually vacation resort real estate properties in which consumers share the rights of ownership and use during a specific allotted period during the year.

However, not all timeshares are created equal. Some timeshare companies have created trustworthy brands that deliver on their promises. Other timeshare companies don’t.

What Are the Pros of a Timeshare?

- You don’t need to plan your vacation location.

- You are not required to keep up the property.

- It may be more affordable than purchasing a vacation home.

- A used timeshare is more affordable.

- Some timeshares have big rooms and resort accommodations.

Many timeshare companies have vacation properties in some of the country’s most beautiful and sought-after locations. If you prefer vacations in a predictable area each year and purchasing your timeshare with one of the reputable companies, you may enjoy some of the advantages of owning a timeshare. On rare occasions, timeshare ownership can be a great way to save money on vacation costs and provide flexibility and freedom when booking vacation time. However, timeshare ownership can also be a financial burden, as maintenance fees and other expenses can increase over time.

What Are the Cons of a Timeshare?

- Reputation for dishonest players and con artists.

- Lack of flexibility.

- The capacity to trade.

- Money flow issues.

- Timeshares do not appreciate in value.

- It may be challenging to sell again.

- Special assessments and maintenance fees.

There are several disadvantages that buyers should consider before purchasing a timeshare.

One of the most significant drawbacks of a timeshare is the ongoing costs. They are included in the timeshares’ upfront cost. Maintenance fees generally increase yearly, with some owners paying thousands of dollars. In addition to the annual maintenance fees, the timeshare owner must pay their monthly mortgage until they pay off the timeshare. The interest rate on mortgage payments is typically high as well. On top of the up-front fee for the vacation property, all of these payments make owning a timeshare a significant financial expense. Overall, a hotel is cheaper than a timeshare resort in the exact location. There is also the benefit of having 0 financial commitment to a hotel room once your vacation is over.

Another issue with timeshares is they offer little flexibility in altering your dates or booking the dates you want in the first place. When you want it, getting what you want sometimes requires booking 12-18 months in advance.

Even if you pay off your timeshare, you are still required to pay maintenance fees for the rest of the term whether or not you use the property. Most timeshare agreements are written in perpetuity, meaning they can last a lifetime.

It is challenging and almost impossible to resell a timeshare. Timeshares also depreciate very fast, and with many owners trying to exit, it’s tough to find someone willing to buy them.

Timeshares have three types: partial ownership timeshares, a shared lease, or a “right-to-use” property. The latter of which the owner holds no claim to ownership of the property.

FREE

Timeshare Exit Info Kit

Get your free Timeshare Exit Info Kit today to learn more about Wesley Financial Group and how we may be able to help you get out of your timeshare.

Timeshare Exit Info Kit

Get your free Timeshare Exit Info Kit today to learn more about Wesley Financial Group and how we have saved 50,000 families over $635 million in timeshare debt.

How Do Timeshares Work?

A timeshare is a vacation home or apartment-like property in which an owner and 2-4 guests or 2-10 guests share a living space for an annual week. Located around the vast majority of the United States Coast, many of these properties are especially common in heavy-tourist areas like Fort Lauderdale, the Gulf of Mexico, and Las Vegas. A condominium accommodation type of timeshare often includes conjoined rooms with separate sections closed off by a unique locking system. This type of vacation option is called a lock-out or lock-off unit. Two-bedroom units like this are either sold together to a prospective buyer or sold separately.

How Much Do Timeshares Cost?

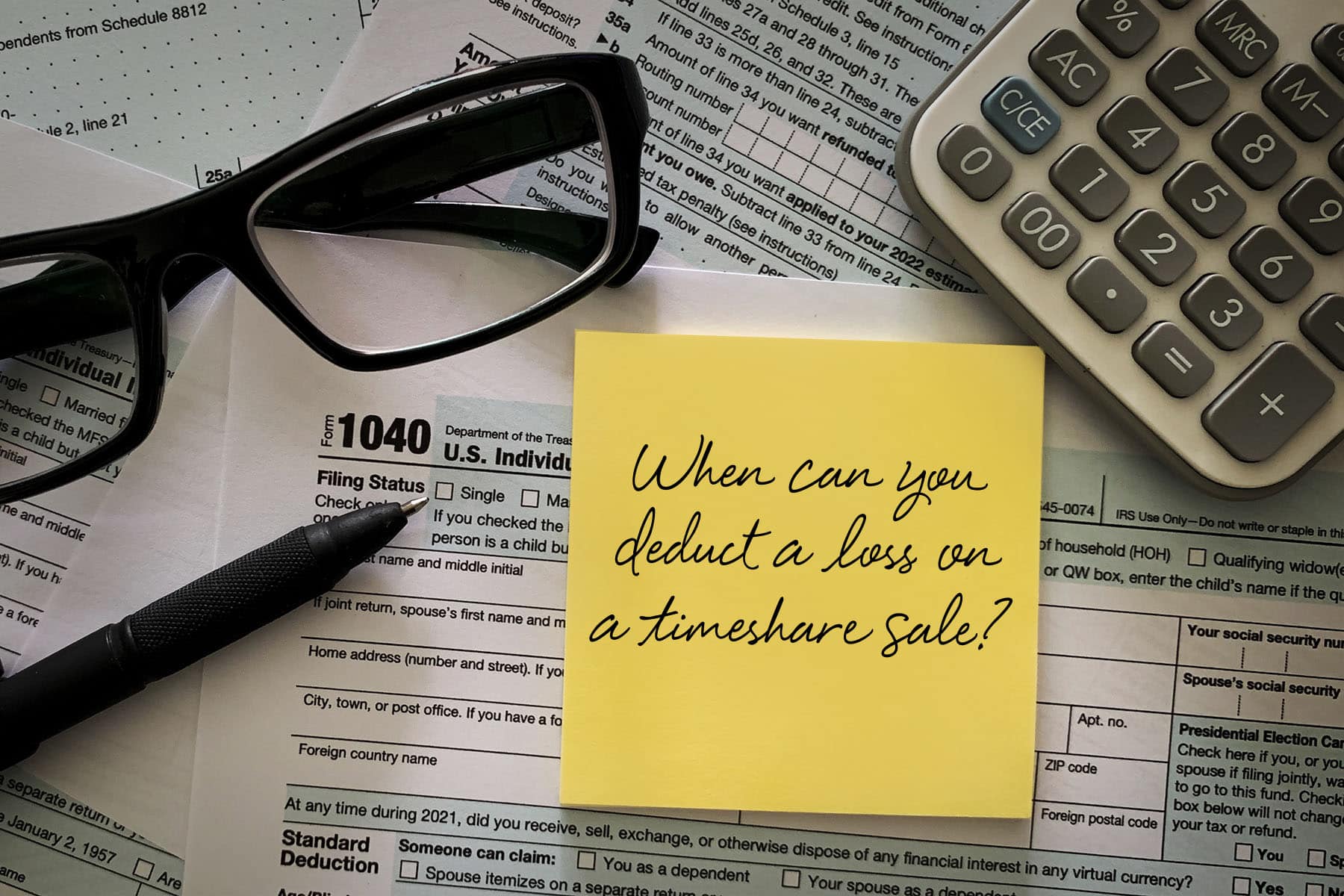

The American Resort Development Association’s (ARDA) statistics show that the typical timeshare interval costs $22,942 USD. On average, annual maintenance fees cost $1,000, but this can vary depending on the size of the property.

If you decide to proceed with the purchase, examine your financial situation to determine how you will pay for the timeshare. Savings may be preferable to financing. Because timeshare properties lose value, most banks will not lend money to them. While timeshare property developers may offer financing options, it is usually at a much higher interest rate than a bank and for a much shorter term. You could also get financing through a short-term personal loan with a higher interest rate.

Types of Timeshare Units

Right-to-use timeshares are pretty uncommon nowadays. When discussing timeshare types, many people are referring to the most popular resort properties offered today: shared deeded timeshares and shared lease timeshares.

These properties are often larger condo units in which the owners retain fractional ownership of the physical property. Today, over 90% of timeshare properties are shared deeded ownership rather than shared lease.

Below is a quick overview of the differences between the two most common types of vacation ownership.

Shared Deeded Ownership

The terms “timeshares,” “interval ownerships,” or “fractional ownerships” are frequently used to describe shared deeded ownerships. Each owner is given a small portion of the current real estate or unit and a deed. There are limitations on how and when an owner may use the property in each deed.

Timeshares are typically sold as deeded property, meaning that the purchaser has ownership rights to the property. In this case, each owner’s annual vacation gets sold in weekly shares. That means that out of the 52 weeks a year, 52 other owners could be staying on the property you invested in. In return, you (and all other owners) have the task of claiming a week that is not already reserved, along with providing the payment for resort amenities and maintenance fees.

What often gets misrepresented in timeshare sales pitches is that during the busiest times of the year, you may not have access to your vacation spot. That means your available vacation time is limited to a schedule you may never have a say in.

Shared Leased Ownership

A shared lease timeshare arrangement differs from shared deeded agreements in several ways. The most notable difference is how property ownership works. The resort owner or developer is the property’s current owner with shared lease ownership. However, the “lease” of said real estate gets sold out to a prospective buyer. Thus, the initial purchase of a timeshare is more similar to a right-to-use deal than a purchase of actual usage time.

Types of Timeshare Systems

Well, there are three standard systems for usage: fixed-week, floating-week, and points-based.

Fixed-Week Systems

With a fixed weekly timeshare purchase, owners can use the vacation property every year for a specific week (or weeks). The upside is that the owner can know they’ll get a particular week every year without stressing about someone else taking it. The downside is that changing or swapping the fixed week may be challenging.

Floating-Week Systems

If you purchase a floating week timeshare, you can use the vacation property for a week or weeks during a specific period. Although, in theory, the floating week might seem more flexible than a fixed week, the trouble lies in booking when you desire. For example, if your family loves to take vacations on Memorial Day weekend every year, it could be fully booked, and you would have to try and reserve it way in advance.

Points-Based Systems

A points-based timeshare, sometimes referred to as a vacation club membership, is an ownership model in which owners receive a specific number of points each year instead of a set amount of weeks. Owners can then exchange these points for lodging at several in-network resorts. Points are the newest system within the timeshare industry, and many timeshare companies only operate on a point system. Points can be used to book vacation time at various properties within the timeshare company’s network. The number of points you have to use to book a trip varies based on the vacation property, location of the property, and time of availability.

Many timeshare companies use a points-based system to utilize their internal or external timeshare exchange program. While the points system will enable owners to choose where they want to vacation, it can also limit users’ ability to travel when and where they want to travel. That means points do not come with a set week or location, so using points to book a vacation can be difficult if the resort you want to stay at is booked two years in advance.

What Are Timeshare Points?

The ownership of timeshare points is becoming a common substitute for traditional, fixed-week timeshare ownership. Members of points-based timeshare clubs own a predetermined number of annually allotted units rather than the right to occupy a specific resort’s predetermined-sized units (generally known as points). While this might give owners flexibility, it is also harder to book a vacation in many cases.

Availability can be tough to navigate depending on the season unless you buy more points to bump you up and give you high enough status to book longer stays during busy times. The disparage of time allotted per family is often a risk of debt accumulation. Owners are encouraged to spend more money to gain more points, so they have a monopoly over the property. What is the difference between a timeshare and a vacation home?

The most considerable difference comes in the form of a proprietorship. Much like a traditional house, a vacation home gives you certain liberties instead of a timeshare. You can rent it out on holiday weekends, make any changes or upgrades to the property or even sell it if you want. The hardest part might be the initial investment or paying a mortgage on a house you’re not living in all the time.

In some instances, timeshares can offer more popular destinations than vacation homes. Though you don’t have to perform maintenance work, there are timeshare maintenance fees that increase yearly, making it an unpredictable financial obligation.

Is a Timeshare a Good Investment?

Although “good” is relative, many experts agree that timeshares shouldn’t be regarded as “good.”

Despite the contrary claims made by the timeshare sales staff, a timeshare is valued as a vacation destination, not as an investment.

While timeshares provide a place to travel and stay frequently, you cannot profit from a timeshare, so there is no monetary return on your investment. It manifests as a guaranteed vacation destination. Although it’s not an investment in the conventional sense, where you can receive a financial return, this could be a wise investment for you and your money.

How Can I Get Out of My Timeshare?

If trapped in a timeshare, the cancellation experience may be challenging because the resort developers may enforce your agreement. It’s a common misconception that owners have no other options, even though some timeshare contracts are typically written perpetually. The following are five recommendations for timeshare owners:

The Rescission Period

The right of rescission is a legal right that allows consumers to cancel certain home loans. In this case, the rescission period allows a timeshare owner to cancel their ownership. Rescission periods for timeshares are notorious for having tiny windows for use. You must move quickly if you intend to withdraw. Please refer to your paperwork for specific instructions, but a rescission usually necessitates a cancellation letter and must be finished within 5 to 15 days. Be aware that leaving will be more difficult and expensive once this period is over.

Deed-Back Program

If the rescission period closes before you can take advantage, you can use the resort’s timeshare deed-back program to give up your deed. Check your timeshare contract to find out if your resort offers a deed-back program. Returning your deed to the hotel enables it to take possession of and sell the property to a new buyer. A deed-back is your best option if you’re looking for a cheaper way to get rid of your timeshare.

Timeshare Resale Market

If the resort won’t accept it back or you miss the rescission period, you might have to do the labor-intensive work yourself. Selling your timeshare is one choice that some timeshare companies advise. Alas, it is incredibly difficult to recoup your initial investment with a timeshare resale purchase. However, it can finally end additional costs like the maintenance fee and property taxes. For some, that’s all they want.

Renting Out

Customers who purchase timeshares can rent their units to third parties for a profit. The truth is that despite its potential to ease the financial strain, renting it out is frequently of only marginal financial support. Listing your timeshare as a rental could be helpful if you still want to keep it but need help covering the timeshare cost.

Timeshare Cancellation Company

A prime example of a timeshare cancellation business is Wesley Financial Group, LLC (WFG). They are a timeshare exit industry innovator and leader with a track record that speaks for itself. Wesley Financial has helped more than 40,000 customers return their timeshare purchases since 2011. Did you fall victim to misleading sales techniques when purchasing your timeshare? Finding out if you are eligible for WFG’s termination services might be worthwhile. We can assist you in taking the necessary actions to eliminate your timeshare.

What Are Some Common Timeshare Scams?

The biggest scam in the timeshare industry is the Timeshare Resale market. Scammers call timeshare sellers under the guise of a reseller or real estate agent. The con artist promises to sell the timeshare for a fair price or asserts that he already has a buyer. Scammers go to great lengths to seem trustworthy.

They create elaborate websites and official-looking documents, use actual companies’ names, addresses, and phone numbers, and hire fictitious escrow agents and title companies—who are merely more con artists. Before calling, some con artists might already know something about you and your timeshare. They may even use the names of friends or a family member to pull you in.

The con artist will convince you that they can sell your timeshare and demand money upfront—typically via wire transfer—to cover closing costs, taxes, or other fees. If you pay, the con artist will typically ask for more money for unforeseen expenses before you realize it’s a scam. In the end, you lost hundreds or thousands of dollars because there was no sale.

How To Avoid Timeshare Resale Scams

- Never send money via a wire transfer or re-loadable money card during a Timeshare sale.

- Be skeptical of anyone who promises to sell your timeshare quickly and at the original purchase price.

- Hang up on sales calls that seem to be pressuring you.

- Don’t be fooled by their professionalism. Do due diligence research on the company before moving forward.

- Contact the relevant government body to determine if the reseller or agent is licensed. Most states mandate that anyone selling real estate holds a real estate agent’s license. The absence of a license from the person contacting you should raise serious concerns.

- Documents that appear official shouldn’t be taken at face value. Scammers’ contracts and money-back guarantees aren’t worth the paper they’re printed on.

- Speak with your resort. It might have a program for you to sell your timeshare or be aware of scams aimed at other timeshare owners.

- Obtain written details about the costs and the due dates. Realistic fees are typically paid after the sale has been completed or removed from the sale price.

What Are Some Tips For Buying a Timeshare?

If you are still on the fence about buying a timeshare, take some time to consider the following advice:

Don’t Fall For the Bribe

Timeshares have a reputation for lengthy, high-pressure sales presentations. Salespeople bribe potential buyers with free meals, tickets to vacation clubs (especially a Disney Vacation Club), and access to hotels in remote locations. Often, purchasers are exhausted by the end of the presentation and agree to deals they don’t fully understand.

Be aware! Many timeshare sales staff members can be found in popular vacation hot spots looking to offer you a “free vacation” or a ticket to your favorite vacation clubs. All they ask in return is for you to attend one of their sales pitches. If you find yourself in one of these presentations, make sure your salesperson tells you the purchase price directly and doesn’t evade your questions. Read through the paperwork carefully, do not just take the salesperson’s word as the truth.

Booking May Not Be Easy

Even though a consumer gets promised easy access to booking and special privileges, sometimes timeshare salespeople offer more than they can guarantee. Points-based timeshare systems come with no guarantees.

In the sales meeting, a representative might say you have the right to use the resort whenever you want. That is not always the case. Just because they say so does not mean you’ll get to use your timeshare unit anytime you want. Another tactic that representatives use is telling you that you can easily trade your week for a different week at another property within their company’s family. Most owners find this nearly impossible unless done way ahead of time.

Many timeshare owners recall hearing these so-called benefits in their presentations, discovering that many aren’t true. The truth always shows itself down the road when owners realize they can’t book just a few months in advance, they can’t trade points, and their favorite week gets blocked by a rule they didn’t see in the fine print.

It’s also important to remember that some destinations are more popular than others, meaning more people will be competing to travel to the places you want in the same week.

Upgrades

Timeshare companies are also notorious for pushing owners into “upgrades.” Suppose you call the resort to complain about being unable to book your desired trip. In that case, they often explain how the package you bought wasn’t “enough” and why you need to buy more timeshare points or credits to take full advantage of all that timeshare ownership offers. It can feel like an endless pyramid scheme at times.

Health

Another primary consideration is your health. That vacation resort property across the country may seem like a great place to visit today, but when you are in your eighties, you may not be so keen on traveling. Although you may be traveling, the charges will never stop. Consider that your desire to travel will decrease with age and health concerns.

Think It Over

Like any major financial decision, you shouldn’t impulse buy a timeshare. If you attend a timeshare presentation, do your best to avoid buying anything on the first day.

Timeshare Agreements Can Be Binding

Trying to rid yourself of your timeshare agreement is not a walk in the park. Since you signed the dotted line, it is not always easy to get out of. However, there are a few options for you, especially if you feel you were manipulated into purchasing your timeshare:

- Contact your timeshare developer and state your case while attempting to reach an agreement with them about getting out of your timeshare

- Try to rent or sell your timeshare online

- Use a legitimate timeshare exit company

Watch Out For Fraud

Watch out for fraud within the timeshare cancellation industry.

Victims of timeshare exit fraud often report scam phone calls telling them they have a timeshare buyer on the other line and need an immediate answer. They may ask you for payment but never agree to pay someone before doing your research. Also, beware of any company that cold calls you or harvests your information as a “lead.” They are just trying to make as much money off you as possible, and chances are they can’t deliver.

Summary

A timeshare unit can be a valuable alternative to vacationing for you and your family. But it comes at a cost. Before signing any dotted lines, you must be aware of various timeshare units and systems.

If you’re not ready to purchase a unit with a few stipulations, you might be better off just vacationing in different hotels. Timeshare units and the annual dues attached can cause financial stress on families that were otherwise happily unaware when signing up. If you are interested, be sure to do your research, so you know the details of your timeshare upfront. If you have other questions or concerns after reading this article, get in touch with a Wesley Financial Group, LLC representative today. We may be able to help you out of your current unfortunate situation.

Over 50,000 families helped!

Find out if you can cancel your timeshare. Schedule a FREE consultation with timeshare cancellation experts now.

Get Rid of Your Timeshare

Schedule a FREE Consultation with one of our timeshare cancellation experts who have saved families over $635 million.